If you are a dependent undergraduate student, a PLUS loan enables your parents or stepparents (but not your legal guardians or grandparents) to borrow money that can be applied to your educational expenses.

PLUS loans are loaned directly from the federal government to the borrower. This loan is not based on your family’s income or asset information provided on the FAFSA.

Requirements:

- Must be a dependent student

- Have a completed FAFSA on file

- Parent must meet the credit eligibility requirements.

- Must be enrolled at least half time.

Steps to Completing the Parent Plus Loan

Step 1 ~ Granting parent borrower myWSU access

The student grants the parent borrower Third Party Access to the form.

- Log in to myWSU and enter the Profile menu

- Select Third Party Access from the left navigation

- Click on the link for Share My Information under the WSU Students Section

- You will see any authorizations you currently have on your account and be able to add authorizations from this screen

- You will be asked to provide an email for the person you want to share your information with. This is important, as we will communicate action steps to your parent borrower through this email. You will also be sent the same communications to your WSU email address.

- If your parent has a Friend Account (FID) with WSU already, select “Yes”, or if you are unsure, select “No.” This may occur if you have an older sibling who has attended WSU.

- If you selected “Yes” insert your parents email address and click “continue”; if your parent does have a Friend Account a notification will be sent to their email notifying them of the authorized access.

- If you selected “No” You will be taken to a screen where you will be asked to provide First Name, Middle Name or Initial (optional), Last Name and a valid email. This information will also be verified in the WSU system, and a notification will be sent to your Third Party notifying them of the authorization.

- Now you will choose the information you wish to share. In this case you will want to grant access to the Parent PLUS Loan application.

- Note: Checking the Grant All Access box will NOT automatically select the Parent Plus Loan Application. This needs to be manually selected.

Step 2 ~ Parent completes WSU loan application

The parent completes the WSU PLUS Loan Application.

- Log in to the WSU portal at myWSU with your Friend ID and password.

- Click on the Third Party Access tile.

- On this screen select the “Access Student Shared Information” link of the student you want to review. If you have multiple students at WSU who have authorized Third Party Access, you will see them listed on this screen.

- Upon selecting the student, the parent or third party will see the areas they are authorized to view. The user can then select the option to view. Select the Parent PLUS Loan Application.

- Fill out the application with your demographic information. The form will be asking you some questions about history or ties you may have with the school. This is so we don’t create duplicate records for you in our system.

- Under the “Loans Details” section of the application, you will indicate the total amount of the PLUS loan you would like to borrow. The application will pre-populate with the maximum amount you can borrow. However, you can reduce this amount, if desired.

- The application also gives the option for any excess PLUS funds to be sent to the Parent borrower. If you would like to select this option, click on the link that says: “If you would prefer to have excess Parent PLUS funds sent to you, the Parent Borrower” and fill out the necessary information.

- Once you have completed the application, click “Submit.” A confirmation page will pop up once the form has been submitted and a confirmation email with further instructions will be sent to the student and the parent.

Step 3 ~ Parent completes MPN

Parent borrower must complete a Master Promissory Note (MPN).

The same parent who completed Step 2 must also complete this step.

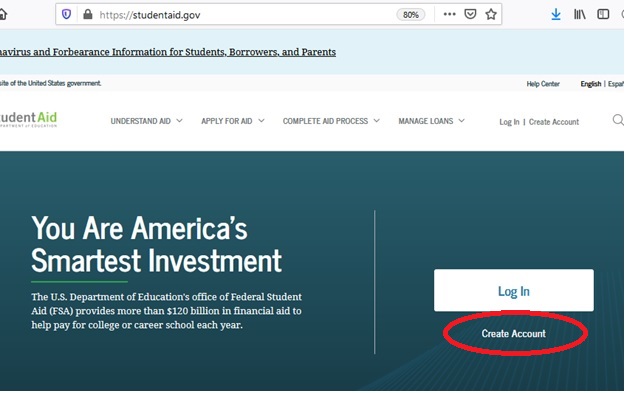

- Visit the Direct Loan website at StudentAid.gov.

- Sign in with your FSA ID.

- Click on “Completed Loan Agreement (Master Promissory Note)” and select the “PLUS MPN for Parents” link to complete the MPN electronically.

- Complete your MPN by signing it with your FSA ID.

- Pending the successful completion and approval of the credit check and the loan process, the funds will deliver to the student’s WSU student account.

Need help?

Federal direct loans — If you have any questions about your Parent PLUS credit decision (denial of credit, loan amounts, etc.), call the federal Student Loan Support Center toll-free at 1-800-557-7394.

Financial aid questions — Contact Student Financial Services for help with any aspect of financial aid at WSU.

myWSU technical support — If you are having trouble logging into myWSU with the correct information, please clear your browser’s cache, history, browsing data, etc. If this does not work, please try another browser or contact the Crimson Service Desk at (509) 335-4357.

Contact Student Connections to:

•Find your loan balance and monthly payment amount

•Discuss available repayment plans

•Explore options to reduce or delay your payments

WSU’s 3-year Cohort Default Rate:

0.0%

Every 3 years, the US Department of Education informs institutions of the loans that have gone into default and provides them with their Cohort Default Rate – the percentage of student loans in default during the 3 years. All Family Education Loans (FFEL) and/or William D. Ford Federal Direct Loans are used as part of this rate calculation. Cohort default rate as of FY 2020.Other key information

WSU uses its own “in-house” loan application for processing Direct PLUS Loans found on myWSU versus the federal government’s application found on studentaid.gov. SFS’s PLUS application is only accessible to you once Third Party Access has been granted to your parent borrower and in turn, links it directly to your myWSU account.

The Benefits of WSU’s PLUS Application

- Both your parent borrower and you will receive all communications about the loan’s status; where just your parent receives this information when the application processes through the federal government’s system.

- Troubleshooting is quicker and updated more often with WSU’s application versus possible delays in the federal application. This allows SFS to be more responsive to your needs.

- Because the application links directly with your myWSU account, duplicate applications for the same loan are eliminated.

General Reminders about Direct PLUS Loans

- The U.S. Department of Education is the lender.

- The borrower must not have adverse credit history.

- The maximum loan amount is the student’s cost of attendance (determined by WSU) minus any other financial aid received.

If a parent is denied the Parent Plus Loan

A parent borrower who is denied a Direct Parent PLUS Loan because of adverse credit information has certain rights and options. A parent may take the following actions to see if the loan may still be approved:

- Appeal the credit decision: Appeal directly to Federal Direct Loan (FDL) Program. They can be contacted at 1-800-557-7394 (Option 3) for more information.

- Add an endorser (co-signer) to the loan: Obtain a credit-worthy endorser (co-signer). An endorser is someone who does not have an adverse credit history and agrees to repay the loan if the student is unable to repay it. The endorser may not be the student. An Endorser Addendum must be completed by the loan co-signer, and submitted to the Federal Direct Loan program for processing. For instructions, please contact Direct Loan Applicant Services at 1-800-557-7394 (Option 3). A parent with an endorser must complete the MPN each year.

In either of the above cases, it is a requirement that the student 1) Contact our office to let us know if they are pursuing one of the above options, and 2) Complete PLUS Counseling at studentaid.gov before the loan funds can be disbursed to the student.

How to add an endorser to a PLUS loan

The endorser agrees to repay the Direct PLUS Loan if you do not repay it. The endorser cannot be the student on whose behalf you are borrowing.

The endorser takes these steps

- Create an FSA ID and sign in at studentaid.gov.

- Click on “Apply for Aid” and then select “Endorse a PLUS Loan.”

- Enter the last name of the parent/graduate student borrower and the Award Identification Number.

The Award Identification Number can be found in the denial email received from the Department of Education. The ID starts with the student’s SSN followed by a code starting with a letter, the last 2 digits of the current aid year, the school code “G0380000” and ending in the number of PLUS Loans sent to Department of Education. If a student has been offered multiple PLUS Loans, the Loan ID will end in “1”, “2”, etc. (example: XXXXXXXXXP19G03800002). NOTE: The current aid year is the year the academic year will end. Example: 2020-2021 = (student SSN)P21G03800001

The borrower takes these steps

Once the parent/graduate student has obtained an endorser, the final step is for the borrower (aka the parent/graduate student) to complete the loan counseling requirement. To do this:

- Go to studentaid.gov

- Log into the site with their FSA ID

- Click on the arrow to the right of “I’m a Parent”

- Click on “Complete PLUS Credit Counseling”

Department of Education will send our office the updated file once the PLUS Counseling has been completed. It can take the university a few days to receive the file and get it updated in myWSU.

Changing direct deposit information after Parent Plus Loan application has been submitted

1. If a parent submitted an application requesting refund to parent and needs to go back to add or

edit direct deposit information then they log in to myWSU

2. Click on the 3rd party tile

3. After submitting the parent plus they have a new link on their menu, they click on this link to

add or edit direct deposit information. “Set up Parent Loan Direct Deposit”

Additional unsubsidized direct student loan

If a Parent PLUS loan application is unsuccessful, a student may request to borrow additional funds through the Federal Direct Unsubsidized Loan program.You, the student, may only apply for the additional Direct Unsubsidized Loan if your parent(s) have been denied. If the Parent PLUS Loan is later approved, the student will no longer be eligible for the additional Direct Unsubsidized Loan.

The PLUS Loan denial must be on file with our office before an increase to your additional unsubsidized student loan can be processed. To make a request to borrow the additional funds through the Federal Direct Unsubsidized Loan Program, you will need to complete WSU’s Parent PLUS loan decline form.

Once WSU is advised that you are not pursuing the PLUS loan, and you’d like the unsubsidized Loan funding offered to you, the PLUS loan will be cancelled and a supplemental direct unsubsidized loan will be offered to you.

The maximum additional amount you may request is $4,000 per year for freshmen and sophomores, and $5,000 per year for juniors and seniors. You will then need to accept the additional loan in myWSU.

Other options to consider

Sometimes, the additional direct unsubsidized loan the student receives from the PLUS denial processing is still not enough to cover the remaining cost of attending WSU. In these circumstances, a student and/or parent may want to consider the following alternatives:

Frequently Asked Questions

Who can apply for the Parent PLUS loan?

How to Apply for the Parent PLUS Loan?

How long does the credit check take?

What if my parent’s credit is denied?

What is the interest rate on the Parent PLUS loan?

Loan amounts & limits

Parent PLUS loan amounts will vary widely. You parent can borrow as much as they like as long as they are not exceeding your total cost of attendance.

To figure out how much to borrow, follow this equation:

Total annual cost of attendance — Other aid awarded = $ parent is allowed to borrow

Should you get a Parent PLUS loan? Use these resources from studentaid.gov to make an informed decision.